Questions I hear about effective CEO succession planning for small business owners are in the main about what it is, why you should be thinking of it ahead of time, and what are the benefits. This article walks you through some of the key considerations.

PREFER TO LISTEN?

Why talk about succession planning for small business owners anyhow?

Well, many SME (small to medium sized enterprise) business owners simply aren’t prepared for when they need to take themselves out of the business. So, I’m not just talking about retirement and planning for retirement, it could be anytime – from a sudden illness or just you’d like to take an extended trip and want to be free to enjoy it.

I have to say, I’ve experienced a period of health challenges where I had to step out of the business – both the consulting and online education side. It’s where much of the Academy mission comes from, and the focus on leveraged living.

While I’ve never taken an extended trip, I’d like to think I think I could if I wanted to! I could probably do it for a month, maybe even 2-3 months, but what about if you needed longer, like 6 months, a year take a world cruise or a couple of years to handle a health issue for yourself or a family member.

In this episode, I’m going to talk through some of the questions I get from people on effective CEO succession planning, in the main: what is it, why you should be thinking of it ahead of time, and what are the benefits.

And I’m not talking here about family businesses with 2-3 staff, I’m talking about a small to medium size business of up to 250 employees, and where most often the owner has no family members active in the company. There aren’t any obvious successors in line to take over as CEO. And in many cases, the owner is CEO, COO, CFO as well as overseeing strategy, operations, HR, IT and marketing/sales!

That’s pretty exhausting, so way before you go, it’s not a bad idea to be building a crew to support you – that’s the only way you’re going to grow and scale in a sustainable way. So, succession planning, goes hand in hand with team building, hiring, talent management and leadership development.

So let’s get going with some of the questions …

Question 1

What is CEO succession planning for small businesses?

In corporate speak, succession planning is the process of replacing your organisation’s leaders and managers with high-potential, internal and sometimes external people. Essentially, it is about forward planning and talent management, which involves identifying, developing, redeploying or replacing certain individuals to handle staff changes as smoothly as possible.

For sole traders, this is about both building capacity for when you are away and if you want eventually to exit the business or retire. For small businesses, where there are perhaps just 4-5 key posts including your own as CEO, such as operations, marketing, sales, HR and IT, succession planning is simply a good idea to cover contingencies like key people leaving the company, long term illness or family issues, maternity or paternity leave.

For larger companies, succession planning is likely to form part of the HR annual planning cycle, ideally aligned with performance management, training needs analysis, talent retention, and leadership development.

Succession planning mitigates the effects of a sudden or unanticipated vacancy in a principal position. Although conventional wisdom is that no one is indispensable, replacing a leader or contributor with highly specialised knowledge or competencies is costly and time-consuming.

Equally important, meeting the personal growth, achievement and recognition needs of current employees promotes motivation and boosts morale.

Succession planning in a general sense is important because it supports organisational stability even during periods of significant change. It makes sure that even if important individuals depart, their absence (at least professionally) won’t be noticed and the company won’t suffer.

Question 2

Why should I think about CEO succession planning?

Let me start by saying, the most common reason for not creating a succession plan is that the owner doesn’t think about it – they’re not looking to retire and/or they wouldn’t know where to start. That’s understandable.

Although we all know that we will want to stop work eventually, and if you’re older you may have worries that one day maybe you will become incapable of running the business by virtue of old age or health issues.

The problem is though that many business owners don’t have a clear sense of the steps involved to enact CEO succession planning when the time comes.

Planning for succession has many different goals. In many businesses, it’s about mitigating risk or damage control where the focus is on proactively seeking out talent, or reactively replacing a key leader with minimal disruption.

If you’re bringing in a replacement, ideally you want someone who is ready for the job, has the potential to take the reins effectively and efficiently, and can step into the role fast. If you have time to plan and manage that ahead of when it’s necessary, so much the better.

To do that, you’ll want to think about developing a succession planning framework or process to reduce the risks associated with a more abrupt change in leadership.

Even if it isn’t about retirement, it could be necessary to have someone step in. For instance, if (God forbid) you had an accident, or had to take care of a loved one for a significant period of time, or if you wanted to take a sabbatical of some kind.

Have you thought about who would run your business in your absence, especially if financially you can’t afford to just shut up shop. Do you have a plan? Do you do any talent management? Who’s your right-hand person, your No. 1 to take over from you? (If you’re a trekkie, you’ll know what I mean?) What kind of person would you want should the need arise?

Thinking through the process of effective CEO succession planning will help you, as the business owner, identify possible contingencies or steps to take. And you can stop worrying about ‘what if’.

The great first step is to learn what your choices are. And the best way to do that is to talk to a few business owners who have retired or developed successful succession plans. Ask them how they went about it, what they did first, how they bring new people in to help them with key business processes and develop talent.

You may not be planning to fully leave the business as CEO, dependent on your age and health, but if you are, then it’s useful to narrow the choices.

For instance, if you don’t have a family member to take it over, you might consider two common options, which are either liquidating the company’s assets or selling to a current employee or partner.

In this case, your immediate CEO succession planning would involve sketching out action items for each of these options.

Another reason to explore succession planning for small businesses is that the nature of the business may have changed considerably since you first set up the company. If you spent time doing some visioning for future stability, you’ll know you need to keep innovating in order to survive and thrive.

If you are keen to look into this further, it leads naturally into Question 3.

Where Do I Start with CEO Succession Planning?

In my experience, certainly for SMEs, internal candidates tend to be the best future C-suites of choice. Of course, there are circumstances, such as a turnaround in the industry or a significant shift in your strategic direction, that might call for seeking successors outside the company. But having someone who’s already demonstrated a cultural fit with your mission and values is always going to feel more comfortable and can be less risky than someone entirely new to your business.

If it’s important in your business, as it is in most, to keep up with innovation and respond to complex, ever-shifting market environments, you’ll want a new kind of leader who’s able to create the right social networks and unlock the “latent creativity” of teams. Often, and unsurprisingly, the insider who already knows the business and the ecosystem in which it operates and is a known entity, has the advantage.

So what do you need to be thinking about to get started.

#1 Consider future strategic needs

Start by taking a hard look at the trends happening in your industry, sector and in the lives or businesses of your target market. Pinpoint potential future challenges and needs, then get to work on your strategic plan. You should ideally be doing this annually anyhow!

Maybe there are new business areas you want to pursue, new markets you want to enter or new products you know you wish to develop. This helps you consider the key areas and functions that are currently mission critical to your company’s growth and success.

#2 Identify operational key roles

Start with a good hard look at the real ‘on the ground’ way that your business operates. Within the areas and functions that are of strategic importance to your company, there are a number of roles and positions that are really key. Ask yourself the question: “If these key positions were vacant tomorrow, how would it affect the business?” Furthermore, identify key competencies, skills and success factors that are critical to the people in those roles doing the job effectively.

#3 Think about your personal needs

If you’re the founder of the business, it can be incredibly hard to hand over the baton. Planning for transition isn’t just about the structural and practical matters. There’s an important personal and emotional level that often requires a mindset shift. When you’ve built up a successful company and have a legacy, you’ve put your heart and soul into it, blood, sweat and tears. It’s entirely normal to want that to be recognised, maintained and continued.

At the same time, few markets are static and every business needs to innovate at some point as part of risk management and future growth. Developing a healthy team environment can really help make the transition one of creativity and collaboration. This is the area of expertise for another business owner I work with, take a look at BridgePoint Effect.

#4 Pick the best approach

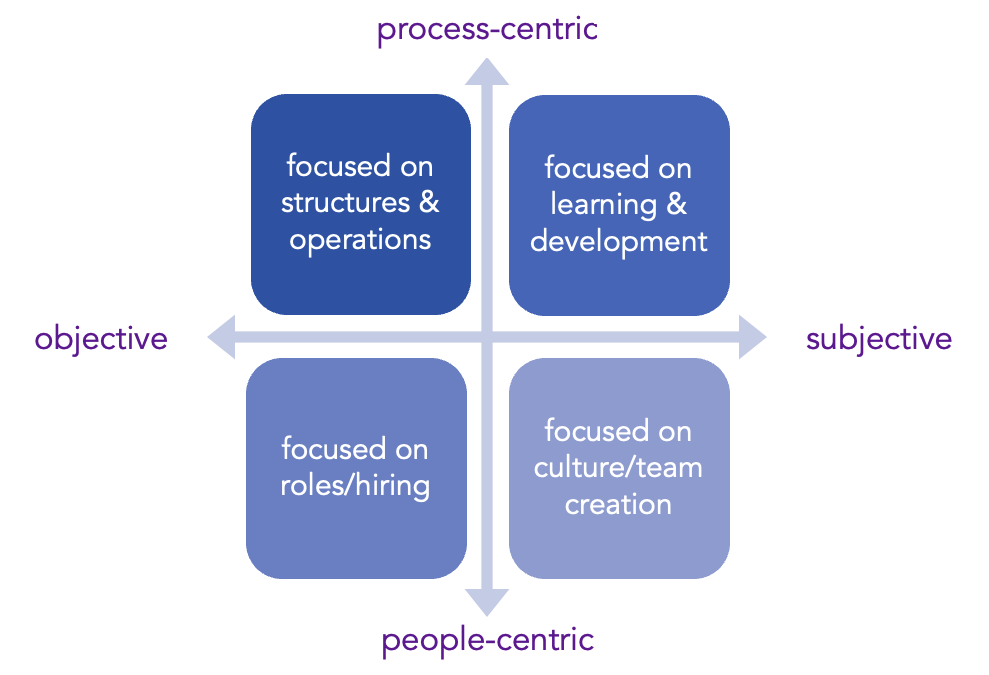

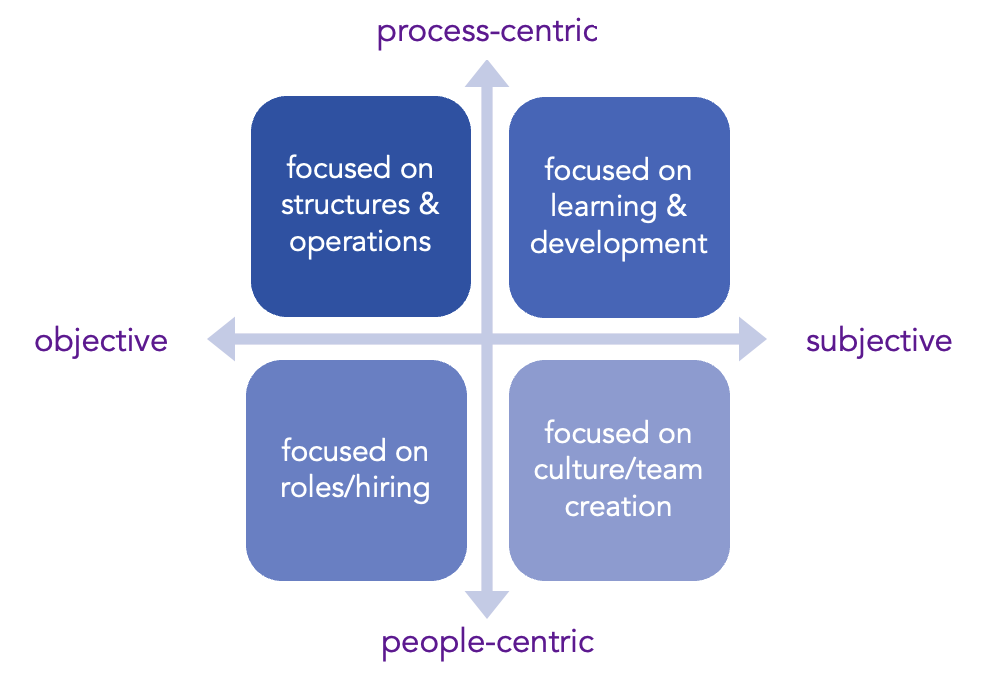

There are two main axes you want to decide on for creating your succession plan. At the extremes, these are:

(1) process-centric or people-centric;

(2) objective or subjective.

Imagine this as four quadrants. Where do you sit? How far off the centre are you to ensure a balanced mix of all four quadrants.

Talent development and leadership development are terms you might know more from the corporate environment, but they’re equally critical to small businesses.

#5 Retaining your best people

Whether you’re thinking of CEO succession planning as a contingency measure or because you’re planning to step back or retire, bear in mind effective succession planning is a process but it’s also a lot to do with people development.

Talent development and leadership development are terms you might know more from the corporate environment, but they’re equally critical to small businesses.

Both talent development and leadership development start with the employee and should identify how their career path can develop and their potential be reached. Succession planning, on the other hand, starts with the critical roles that need to be filled, after which you can identify which contenders that might best fit these positions.

To retain key personnel and keep development initiatives going from a succession viewpoint, talent management and succession planning should be connected with one another.

The Academy to Innovate HR (AIHR) has a nice four-step success planning process template that illustrates the various developmental activities that might be involved at each stage of the process.

The 4th question I get asked by small business owners who are already looking into succession planning is…

What are the Benefits of Succession Planning?

The main benefits I hear small businesses talk about in relation to succession planning is that it keeps hiring costs down, improves employer brand and boosts retention rates all at the same time!

Succession planning is the epitome of planning for the worst by expecting the best.

This is so that in your business, you may prepare for significant departures and grow current personnel by preparing them for potential leadership roles.

Whether you refer to it as anticipatory workforce planning, succession planning, or anything else, it’s something that will undoubtedly benefit you personally. You can step away from your business from time to time, or transition out of it over time, with the peace of mind. Being able to hand over the reins on occasion also gives opportunity for your staff to step up, to feel a sense of pride, motivation and job security. And that benefits your business in terms of talent retention, stability, and obviously succession!

A question I hear from larger SMEs or small partner firms who are looking more externally to replace a CEO is our question 5 for today.

How can a board go about finding a new CEO who’s equipped to deal with 21st-century challenges?

Well, if you’re a well-established or larger consulting type business, there’s a useful article in the Harvard Business Review (attributed to Victoria Luby and Jane Edison Stevenson) that outlines seven defining tenets of a “gold standard” succession process.

But for small businesses, that deeper CEO succession planning can feel like overkill. The one thing that does apply to both however is ensuring that your talent management and development planning is linked to your long-term business strategy. This way you can start well ahead of when you actually need to find a successor!

Start engaging your team in discussions that help clarify or define both short- and longer-term business priorities. And talk about this in relation to their career aspirations, skills gaps and personal attributes required in the leadership of the business. One idea in the HBR article is to create a CEO Success Profile to use as a blueprint for evaluating internal and external CEO candidates. And you can use this as part of succession planning to drive performance management and talent development as well.

Successful successors are the result of years of preparation, mentorship, and coaching — preferably up to five years before a planned transition — to make sure they gain the experience and skills needed and have a chance to develop their internal hardwiring before taking command as CEO.

There seems to be two preconditions for effective CEO succession planning:

(1) The creation of a culture of leadership, which involves more than just leadership training, but also active participation in shaping future leaders – development, shadowing, mentoring, appraisal, recognition and reward.

(2) The selection of critical roles, which were they to become vacant for a few months – or filled by a bad hire – would create irreversible damage for the company.

What you want to avoid is looking around the company for people you trust could do the job. It’s a process – these people will need development and support. You’ll need to invest in them.

The easiest way to identify your top talent and critical roles is to consider the most senior members of the organization’s structure or the highest paid employees. This choice will be reasonably accurate if the organisation has a clearly defined job architecture. One of my clients in our year-long ACES program – the Birches Group, an HR Consulting firm – specialises in this area, and I learned a tonne about just how deep the rabbit hole can go!

In terms of C-suite functions, one simple way to look at this is by considering whether the scope of a given functional role is strategic or operational. There are a few other parameters than can help illuminate talent, and that’s to identify who’s doing a great job.

Look at not only their knowledge and experience, but also their attitude and values, how do they show up, how do they relate to others in the team. Make a note too of if or how you’re recognising and rewarding them.

Think about that job’s sphere of control, the impact of function on value creation in the business, the severity of potential mistakes in the function, the level of compensation, and the severity of consequences of a bad hire.

Here’s a table with some prompts and pointers to assess your current talent pool.

| EXPLORATORY QUESTIONS | ACTION STEPS |

| 1. Does this person/position have a leadership role in the company and a large role? | Be proactive with a plan |

| 2. Are tasks performed by this person complex? Does their position require specialist knowledge? | Identify talent or succession candidates |

| 3. Is there a high risk of this person leaving to a competitor? | Let them know and explain the stages |

| 4. Would filling the position be protracted and costly? | Step up professional development efforts |

| 5. How long will it take to train a potential successor? | Integrate your succession plan into your hiring strategy |

| 6. Are decisions made by this person significant to the company? | Do a trial run of your succession plan |

If you’re the CEO looking to plan your own succession, then the answer to the above six questions is undoubtedly a big yes – so if you’re serious about exploring this, you really need to spring into action!

There are extensive frameworks for identifying competencies in potential candidates. For instance, the 9-box model, also known as the 9-box talent matrix created in the 1970s by McKinsey – or the advanced 16-box version reported here – is a tool used to map, analyse and compare employee work performance and potential. It helps you (or your HR person) effectively identify leaders and strategically prepare staff for future roles.

Next question I often hear from clients is …

When Should I Create a Small Business Succession Plan?

To maintain operations and prevent service interruptions for clients or customers, every business should consider putting a succession plan into play. If you’re already considering exiting the business, or you know you have health issues or want to retire, you should create one as soon as possible.

Even though you may not have any plans to leave your company, accidental departures may occur and effective CEO succession planning will guarantee that the company runs efficiently and effectively throughout the changeover.

For CEO succession planning to be successful, you need to think about whether your company currently has the talent to replace you. This means that, even if it is cheaper to fill a position internally, it does not guarantee that a current employee is up to the task – at least not yet.

In fact, an employee may not be qualified for the role, or they also may not be interested. They may have the technical expertise and not the softer skills; they may be great operationally, but lack strategic thinking; and they may lack the external networks that fresher candidates.

Actively planning for your succession well ahead of time means you’re covered if you have to leave unexpectedly at short notice and ensures continuity. If you’re able to help transition and mentor the person before they move fully into the CEO role, this can help with getting others on board with the new leadership. Occasionally external candidates can be brought in as associates in the company to provide back up on an ad-hoc basis, without taking over a new role to spread the risk.

Succession planning for small business owners is the ultimate continuity and ensures that if you have to leave, or when you decide to leave, there is someone else who is prepared to step into that position and keep things running smoothly, and who could take the mantle for future legacy and growth.